I have had over a month now to let the whole idea of bitcoin settle in my life and I have only used it a very small amount. There are still very few merchants that accept bitcoin so that makes things hard. I did buy an SSL from ssls.com and everything seemed really easy. I just selected Bitcoin as my payment type then I had a short window to send a specific about of Bitcoin to an address. I sent it out in time and it went through without a hitch.

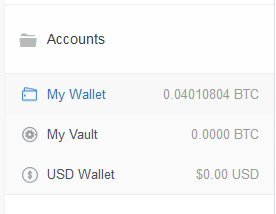

Recently, a buddy of mine was wanting to buy some bitcoin to see what it was all about so I sent him a little bitcoin and he paid me in cash. What I did find a little weird was that on my coinbase account, it showed as pending for quite a while, like at least an hour. But it all went through and the small amount I sent was instantly deducted from my coinbase wallet.

Since I opened my account, the value of bitcoin has appreciated to ~$425. If I had put in a lot of money, that would have been a fantastic return of over 10% in less than a month. But, my coinbase account currently limits my instant buy transactions to $100 / week and slow bank buys to $2,500 per day. If using the bank method I guess I could invest a nice chunk of money over several days but that is not practical like an online brokerage account is for stocks when there are no caps as long as you have the money in your account to trade with.

So this seems to be the main issue with bitcoin as a mainstream currency. Right now, it seems much more like it would be used as an investment to hold on to and eventually cash out for “real money.” At least, that’s how it feels to me. I don’t even see 1% of my buying being viable for bitcoin. This leads me to the idea that when the masses have a realization that a money is not being used as money, what worth does it really have? At that point I could see the bottom falling out and the price of bitcoin dropping dramatically. But, on the other hand, nobody pays for anything with gold or silver and they seem to retain their value pretty well.

Also, Bitcoin has another more nefarious use. Given the fact that this currency can be used without any personally identifiable information, it is popular for use in black markets. People can download Tor, and find their way to sites that will hook them up to people willing to sell drugs, sex, weapons, or even assassinations I have heard. The currency of choice? Bitcoin. This is where I would guess a lot of the transnational use of bitcoin comes in to play. Eventually though, you have to convert that bitcoin into cash to really use it to buy anything like stuff off of Amazon, eating out in a restaurant, paying your rent, etc.